By James Kwantes

Published first at Patreon

Distinguishing between signal and noise is a survival skill for junior mining investors.

Personnel moves can be one meaningful signal, especially as gold flirts with US$2,800 an ounce.

On October 28, Mayfair Gold (MFG-V) announced the appointment of Nicholas Campbell as VP Corporate Development. U.S. hedge fund Muddy Waters and associates took control of Mayfair Gold and its 4.3-million-oz Fenn-Gib gold deposit in Timmins earlier this year after a proxy fight. I wrote about that here: Muddy Waters - and a Golden Opportunity?

Campbell is a former analyst whose last gig was at Artemis Gold (ARTG-V), which is building the Blackwater gold mine in central B.C.

Artemis has managed to execute on the mine build, which was 95% complete as of Sept. 30, despite obstacles including inflation and forest fires. On Artemis increased the capital cost range from $730-$750M to $780-800M - a 7% increase. The stock has almost 3Xed in the past year.

Previously, Campbell was VP Business Development for Eric Fier's SilverCrest Metals (SIL-T), taken over by Coeur Mining (CDE) for US$1.7 billion on October 4 (Quietly Creating Billions in Shareholder Value). Campbell was with SilverCrest from October 2016 to August 2020, a period that saw SIL shares climb from about $2.30 to north of $12.

Back to Timmins. On September 10 Mayfair published a resource update that took Fenn-Gib from 3.3M oz Indicated to 4.3M oz, following that up with a no-warrant $6-million financing at $1.80 a share. Now the company has brought in a capital markets operator with a proven ability to land at high-quality companies.

Mayfair has a good share structure and the successful Muddy Waters proxy fight is evidence of a tightly held stock. Muddy Waters just filed purchases of another $200,000 worth of shares at $2.03 to $2.10. The renowned hedge fund has a track record in mining, on the long side with GT Gold and on the short side with Asanko Gold.

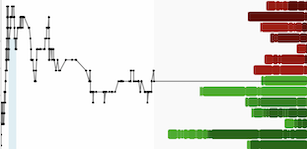

Mayfair went public back in March 2021 at $1.85 and shares climbed as high as $2.75 back in January of this year, with gold at $2,000.

Is it go time, with gold at $2,800? It seems likely.

Price: $2.35

Shares out: 109.2 million (119M fully diluted)

Market cap: $257 million

Disclosure: I own Mayfair Gold shares, purchased in the public market, and have no business relationship with the company. This is not financial advice and all investors need to do their own due diligence.