- Q1 2019 revenue of $305.3 million, an increase $53.7 million or 21.4% over Q1 2018.

- Q1 2019 Adjusted EBITDA1 of $17.9 million, an increase of $6.3 million, or 53.8%, over Q1 2018, including a favourable impact of $1.9 million from the adoption of IFRS 16; excluding this impact Adjusted EBITDA increased by $4.4 million or 37.2%.

- Q1 2019 net income of $1.5 million compared with $1.4 million, representing $0.07 per share in each period.

- Three acquisition completed in 2019 to-date.

LASALLE, QC, May 9, 2019 /CNW Telbec/ - GDI Integrated Facility Services Inc. ("GDI" or the "Company") (TSX: GDI) is pleased to announce its financial results for the first quarter ended March 31, 2019.

For the first quarter of 2019:

- Revenue for the first quarter of 2019 was $305.3 million, an increase of $53.7 million, or 21.4%, over the first quarter of 2018. Organic growth in the first quarter of 2019 was 7.8%, with the remaining revenue growth coming primarily from acquisitions.

- Adjusted EBITDA1 for the first quarter of 2019 amounted to $17.9 million, an increase of $6.3 million, or 53.8%, over the first quarter of 2018. This increase includes a favourable impact of $1.9 million coming from the adoption of IFRS 16. Excluding this impact, Adjusted EBITDA1 would have been $16M, or 37% higher than the first quarter of 2018. All business segments reported increases in Adjusted EBITDA1 over the previous year, including substantial growth in both the Janitorial USA and Technical Services business segments.

- Net income for the first quarter of 2019 amounted to $1.5 million compared to net income of $1.4 million for the first quarter of 2018, representing $0.07 per share in each period. Net income was negatively impacted by $2.1 million, net of tax, or $0.10 per share by the remeasurement of cash settled share-based compensation due to the increase of GDI's stock price in the first quarter of 2019.

- As previously disclosed, during the first quarter of 2019, GDI completed 1 acquisition in the United States, in the Janitorial USA segment. This acquisition positively contributed to the GDI performance for the first quarter of 2019. Following the end of the quarter, GDI completed 2 small acquisitions in the Technical services segment.

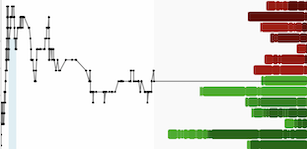

- For the first quarter of 2019 and 2018, the business segments performance was as follow:

(in thousands of Canadian dollars) | Janitorial Canada | Janitorial USA | Technical services | Complementary | Consolidated | |||||

2019 | 2018 | 2019 | 2018 | 2019 | 2018 | 2019 | 2018 | 2019 | 2018 | |

Revenue | 132,875 | 132,402 | 79,022 | 51,614 | 80,664 | 58,581 | 19,864 | 14,419 | 305,314 | 251,578 |

Organic growth | 0.4% | 5.8% | 27.4% | (4.7%) | 6.6% | (7.9%) | 20.4% | 9.1% | 7.8% | 0.3% |

Adjusted EBITDA1 | 9,588 | 8,735 | 6,138 | 2,992 | 3,136 | 1,421 | 1,102 | 737 | 17,942 | 11,664 |

Adjusted EBITDA margin1 | 7.2% | 6.6% | 7.8% | 5.8% | 3.9% | 2.4% | 5.6% | 5.1% | 5.9% | 4.6% |

Adjusted EBITDA – Pre-IFRS 161 | 9,250 | 8,735 | 5,761 | 2,992 | 2,427 | 1,421 | 894 | 737 | 16,007 | 11,664 |

Adjusted EBITDA margin – Pre IFRS 161 | 7.0% | 6.6% | 7.3% | 5.8% | 3.0% | 2.4% | 4.5% | 5.1% | 5.2% | 4.6% |

"We had another very good quarter in Q1, recording $305 million of revenue, an increase of 21.4%, and Adjusted EBITDA1 of $17.9M, up by 53.8% compared to the first quarter of 2018, which included a favourable impact from IFRS 16 of $1.9M. All our segments performed well and recorded increases in Adjusted EBITDA – Pre IFRS 161 compared to the first quarter of 2018. Our organic growth was also very solid at 7.8%. Our Janitorial Canada business performed well in the first quarter and recorded an Adjusted EBITDA margin – Pre IFRS 161 of 7%, resulting from a strong emphasis placed on cost optimization and operating efficiency. Our Janitorial USA business had another record quarter and is performing extremely well, posting Adjusted EBITDA – Pre IFRS 161 of $5.8 million, representing growth of 92.5% over last year and a margin of 7.3%. The Technical services segment also had a strong quarter, with a 37.6% increase in revenue and solid increases in both Adjusted EBITDA – Pre-IFRS 161 and margin1 compared to the first quarter of 2018. We are pleased with the performance in the Technical services segment as Q1 is typically affected by seasonality given the nature of the business, there are less break-fix calls and fewer larger projects are started in the winter, which results in lower margins in the first quarter in this segment. Finally, our complementary services had a good first quarter which was in-line with expectations," stated Claude Bigras, President & CEO of GDI.

"On April 1 we completed two small acquisitions in the Technical services segment that will help to strengthen our position in Southwest Ontario and Atlantic Canada. We continue to build and reinforce our platform across Canada in this high growth segment. GDI's outlook for the remainder of 2019 remains positive, we are working on growing our business both organically and through acquisition and on managing our costs. Our leverage ratios remain well within our comfort zone and we are well positioned to continue to execute on our business plan and capitalize on strategic growth opportunities as they arise," concluded Mr. Bigras.

ABOUT GDI

GDI is a leading commercial facility services provider which offers a range of services in Canada and the United States to owners and managers of a variety of facility types including office buildings, hotels, shopping centres, industrial facilities, healthcare establishments, distribution facilities, airports and other transportation facilities. GDI's commercial facility services capabilities include commercial janitorial, installation, maintenance and repair of HVAC-R, mechanical and electrical systems, as well as other complementary services such as damage restoration and janitorial products manufacturing and distribution. GDI's subordinate voting shares are listed on the Toronto Stock Exchange (TSX: GDI). Additional information on GDI can be found on its website at www.gdi.com.

CAUTION CONCERNING FORWARD-LOOKING STATEMENTS

Certain statements in this press release may constitute forward-looking information within the meaning of securities laws. Forward-looking information may relate to GDI's future outlook and anticipated events, business, operations, financial performance, financial condition or results and, in some cases, can be identified by terminology such as "may"; "will"; "should"; "expect"; "plan"; "anticipate"; "believe"; "intend"; "estimate"; "predict"; "potential"; "continue"; "foresee"; "ensure" or other similar expressions concerning matters that are not historical facts. In particular, statements regarding GDI's future operating results and economic performance and its objectives and strategies are forward-looking statements. These statements are based on certain factors and assumptions including expected growth, results of operations, performance and business prospects and opportunities, which GDI believes are reasonable as of the current date. While management considers these assumptions to be reasonable based on information currently available to the Company, they may prove to be incorrect. It is impossible for GDI to predict with certainty the impact that the current economic uncertainties may have on future results. Therefore, future events and results may vary significantly from what management currently foresees. The reader should not place undue importance on forward-looking information and should not rely upon this information as of any other date. While management may elect to, the Company is under no obligation and does not undertake to update or alter this information at any particular time, except as may be required by law.

Analyst Conference Call: | May 10, 2019 at 8:00 a.m. (ET) |

Investors and Media representatives may attend as listeners | |

Please use the following dial-in number to have access to the | |

Canada/United States access number: 1-800-624-1547 | |

Confirmation Code: 21923167 | |

A rebroadcast of the conference call will be available until May | |

Canada and United States Access (English): 1-800-633-8625 | |

Canada and United States access (French): 1-900-977-6910 | |

Confirmation Code: 21923167 |

March 31, 2019 unaudited condensed consolidated interim financial statements and accompanied Management & Discussion Analysis are filed on www.sedar.com.

______________________________________ | |

1 The terms "Adjusted EBITDA", "Adjusted EBITDA margin", "Adjusted EBITDA – Pre IFRS 16" and "Pre-IFRS 16 Adjusted EBITDA margin" do not have standardized definitions prescribed by International Financial Reporting Standards and therefore, may not be comparable to similar measures presented by other companies. Adjusted EBITDA is defined as operating income before depreciation and amortization, goodwill impairment, transaction, reorganization and other costs and share-based compensation. The Adjusted EBITDA Margin is calculated by dividing Adjusted EBITDA by revenues. Adjusted EBITDA – Pre-IFRS 16 is defined as Adjusted EBITDA without application of IFRS 16 to make it comparable to prior year figures. The Adjusted EBITDA Margin – Pre IFRS 16 is calculated by dividing Adjusted EBITDA – Pre IFRS 16 by revenues. For more details and for a reconciliation of that measure to the most directly comparable IFRS measure, consult the "Operating and Financial Results" section of the Company's MD&A. |

SOURCE GDI Integrated Facility Services Inc.

View original content: http://www.newswire.ca/en/releases/archive/May2019/09/c3552.html